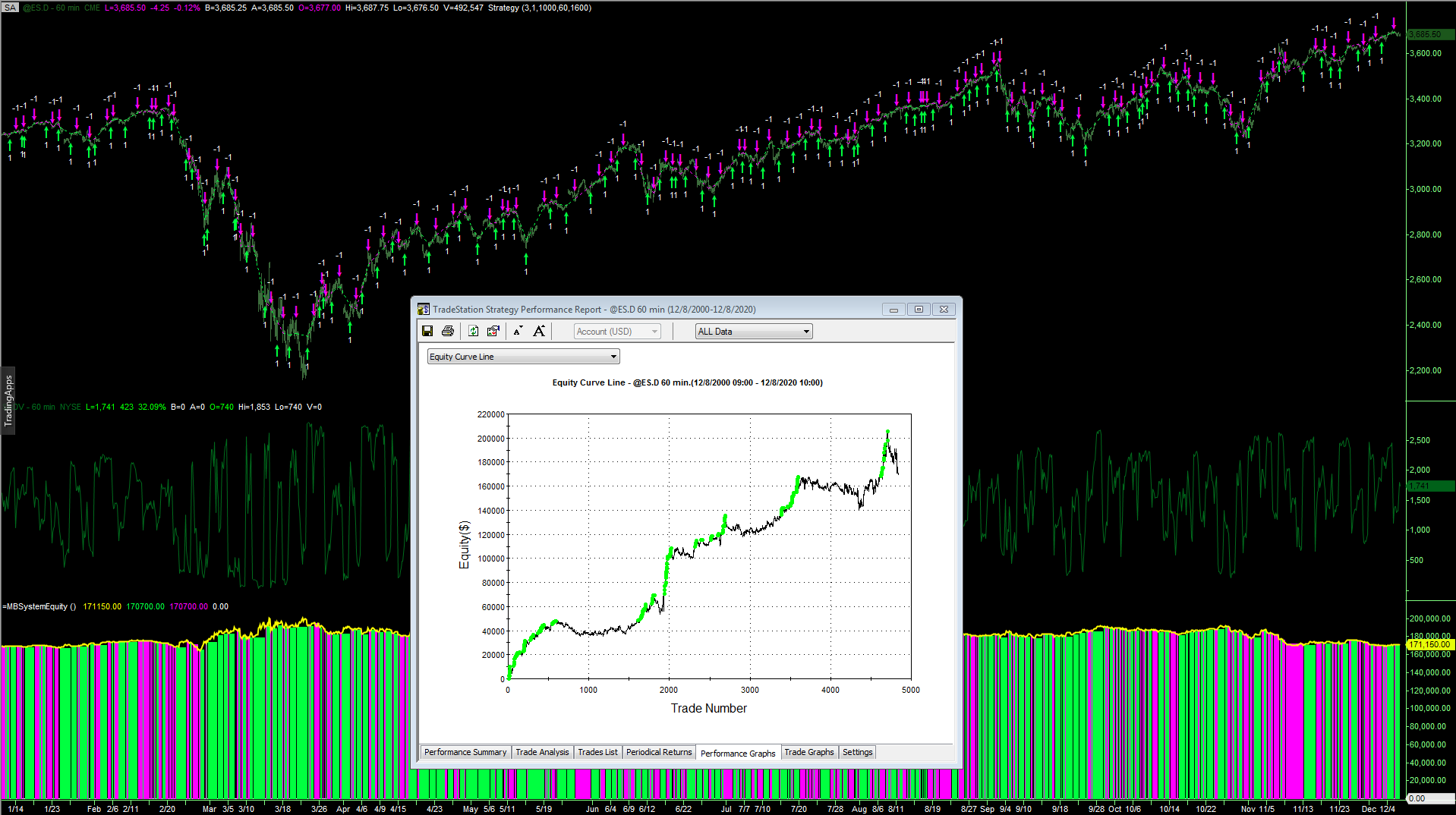

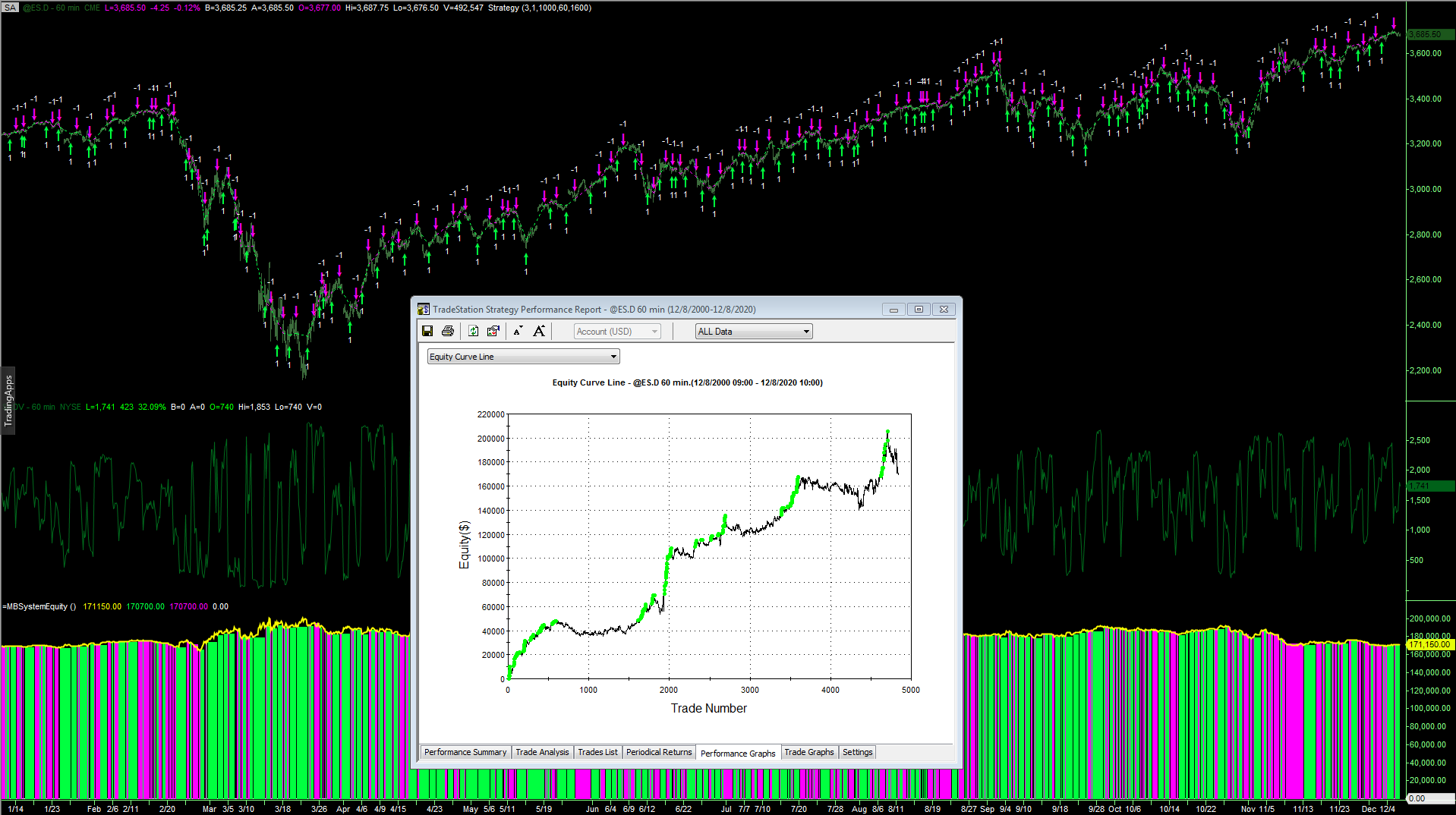

Oddball System 20th year anniversary - 5000 trades

Posted: 08 Dec 2020

20 years ago I published the 1st Oddball trading system in a magazine called Active Trader. Prior to being published a variation of it was used at Regal Asset Management in Dallas for over a decade running on a Ned Davis trading platform called Technalyzer.

In base system form, it's a foundation to build upon and there have been many other more successful variations published by various trading system developers. For a base model it has held up well.

The idea behind Oddball is that it does not use the data it trades in the calculation of the buy - sell signal.

It uses only the NYSE Advancing Issues to determine the buy - sell signals. Simply elegant and an always in model, it trades only natural hour from 9-3 day session only yet holding overnight and weekends, undaunted it has remained profitable with no re-optimization of the original inputs published 20 years ago.

Oddball System article December 2000 .pdf download.

http://www.prosignals.com/oddball/oddball-1.pdf

TS and MC code below. For hourly Natural Hour day session only data.

// Data 1 = ES futures, Data 2 = Advancing issues

Input: Price(C of data2),Length(7),Buyzon(1),Selzon(3);

If RateOfChange(Price, Length)> Buyzon then Buy This Bar;

If RateOfChange(Price, Length)< Selzon then Sell Short This Bar;

In base system form, it's a foundation to build upon and there have been many other more successful variations published by various trading system developers. For a base model it has held up well.

The idea behind Oddball is that it does not use the data it trades in the calculation of the buy - sell signal.

It uses only the NYSE Advancing Issues to determine the buy - sell signals. Simply elegant and an always in model, it trades only natural hour from 9-3 day session only yet holding overnight and weekends, undaunted it has remained profitable with no re-optimization of the original inputs published 20 years ago.

Oddball System article December 2000 .pdf download.

http://www.prosignals.com/oddball/oddball-1.pdf

TS and MC code below. For hourly Natural Hour day session only data.

// Data 1 = ES futures, Data 2 = Advancing issues

Input: Price(C of data2),Length(7),Buyzon(1),Selzon(3);

If RateOfChange(Price, Length)> Buyzon then Buy This Bar;

If RateOfChange(Price, Length)< Selzon then Sell Short This Bar;