In this MC wiki link: https://www.multicharts.com/trading-sof ... ssumptions

it mentions "An order could be executed at every valid price level throughout the entire range of the bar."

What is the definition of a "valid price level"? All my orders in backtesting are occurring at either Open, High, Low, or Close (with IBOG on and Bar Magnifier off). If it considers every price level throughout the bar then shouldn't some orders be occurring at prices other than OHLC? I've tried with both ES futures and the SPY etf.

Can anyone help me understand the intrabar assumptions?

Help understanding "Intra-bar Price Movement Assumptions"

- ABC

- Posts: 718

- Joined: 16 Dec 2006

- Location: www.abctradinggroup.com

- Has thanked: 125 times

- Been thanked: 408 times

- Contact:

Re: Help understanding "Intra-bar Price Movement Assumptions"

Hi ZaphodB,

are you using any order type other than market orders? If not, a market order would be filled at the next code calculation, which in your scenario (backtesting with IBOG on and Bar Magnifier off) is either Open, High, Low, or Close.

Regards,

ABC

are you using any order type other than market orders? If not, a market order would be filled at the next code calculation, which in your scenario (backtesting with IBOG on and Bar Magnifier off) is either Open, High, Low, or Close.

Regards,

ABC

Re: Help understanding "Intra-bar Price Movement Assumptions"

Ok, thanks. I guess I misunderstood that MC wiki article. I guess they mean that a limit order could be executed at "every valid price level" but not a market order. Is there a way to get it to recalculate on every 0.25 movement throughout the range of the bar? I know I could use the bar magnifier but I'd like to have this option too.

Re: Help understanding "Intra-bar Price Movement Assumptions"

Maybe better for a feature request but I wish I had the option of recalculating within bars in a conservative fashion (for a reversal strategy). I wish I had the option for this:

Positive/green bars would calculate at every 0.25 movement in this order, Open to Low to High

Negative/red bars would do the reverse (Open to High to Low)

Positive/green bars would calculate at every 0.25 movement in this order, Open to Low to High

Negative/red bars would do the reverse (Open to High to Low)

- Tammy MultiCharts

- Posts: 200

- Joined: 06 Aug 2020

- Has thanked: 6 times

- Been thanked: 65 times

Re: Help understanding "Intra-bar Price Movement Assumptions"

Hi ZaphodB,

You can post a feature request at our Project Management section.

If you don't have an account there, please reach out to support@multicharts.com, and we will create one for you.

You can post a feature request at our Project Management section.

If you don't have an account there, please reach out to support@multicharts.com, and we will create one for you.

- Mark Brown

- Posts: 182

- Joined: 29 Nov 2016

- Has thanked: 114 times

- Been thanked: 18 times

Re: Help understanding "Intra-bar Price Movement Assumptions"

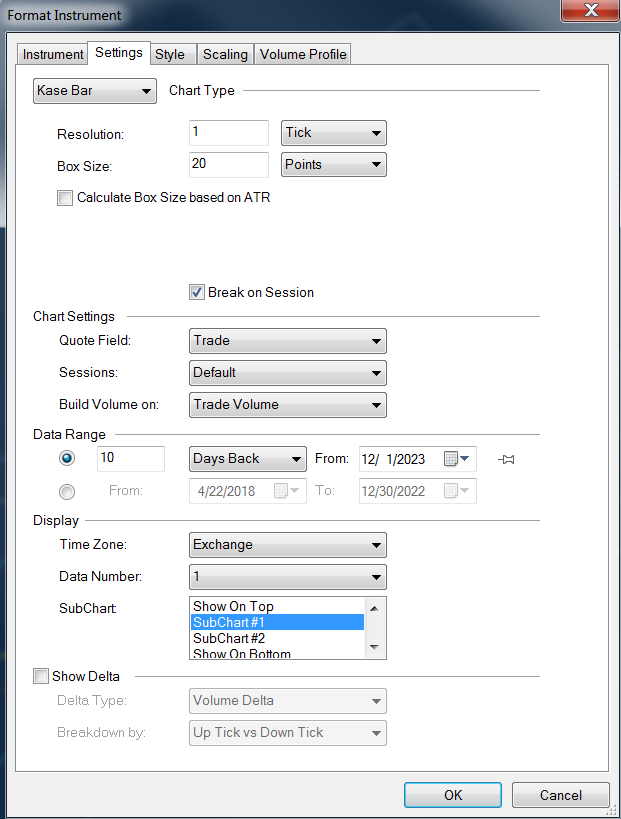

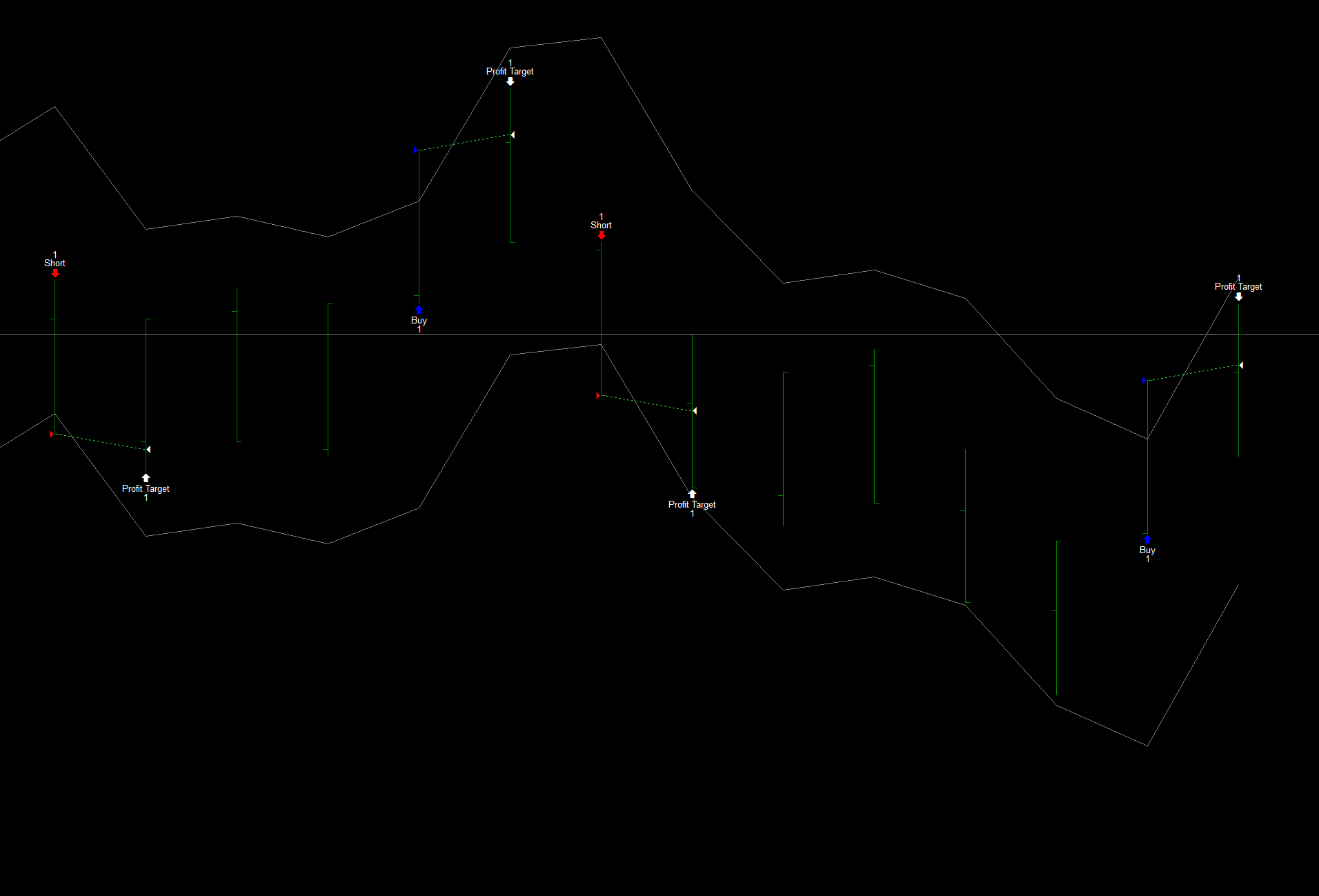

I would like to add to this thread. I have been trying to figure out a way to make a system using Kase Range Bars that will execute a trade within the bar when a condition is met.

So if my order condition is met why can I not send a order to the broker. Why are range bars stuck to OHLC?

So if my order condition is met why can I not send a order to the broker. Why are range bars stuck to OHLC?

- Polly MultiCharts

- Posts: 202

- Joined: 20 Jul 2022

- Has thanked: 1 time

- Been thanked: 55 times

Re: Help understanding "Intra-bar Price Movement Assumptions"

Hello Mark,

There is no difference between order generation on Regular and Kase Bar chart types with regards to Backtesting and Data Playback, Real-Time order simulation, and Auto Trading.

In backtesting Intra-Bar Order Generation is limited by four calculations per bar (Open, High, Low, Close).

In Real-Time if Intra-Bar Order Generation mode is enabled, strategy calculation is done on every tick of a bar.

There is no difference between order generation on Regular and Kase Bar chart types with regards to Backtesting and Data Playback, Real-Time order simulation, and Auto Trading.

In backtesting Intra-Bar Order Generation is limited by four calculations per bar (Open, High, Low, Close).

In Real-Time if Intra-Bar Order Generation mode is enabled, strategy calculation is done on every tick of a bar.

- Mark Brown

- Posts: 182

- Joined: 29 Nov 2016

- Has thanked: 114 times

- Been thanked: 18 times

Re: Help understanding "Intra-bar Price Movement Assumptions"

Thank you for answering - but what you say above does not work at all on 20 tick Kase range bars set to update 1 tick intervals.In Real-Time if Intra-Bar Order Generation mode is enabled, strategy calculation is done on every tick of a bar.

[IntrabarOrderGeneration = true]

in the chart below how can i buy and sell on the band rather than on the close? the bands are static being previously calculated on the bar beforehand.

the price and plot of the band does not change with price - why then when the price crosses the band will the system not trade at the band or market after touch of the band?

[IntrabarOrderGeneration = true]

//band code here

if c<=dnband2 and c[1]>=dnband2 then sell short this bar on c;

if c>=upband2 and c[1]<=upband2 then buy this bar on c;

https://imagizer.imageshack.com/img924/7176/c6nfTw.png <bigger picture

also note i have tried next bar etc....