Cumulative Delta

Contents

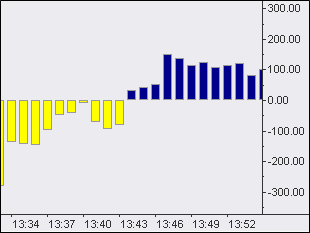

Understanding Cumulative Delta Chart Type

Cumulative Delta is the algebraic sum of the single delta volume values. In comparison to Volume Delta, Cumulative Delta is not based on regular bars. When the Cumulative Delta chart type is used, the price scale of the chart is transformed into volume scale and the formed bars represent not volume within regular price bars, but accumulated delta (buy - sell) of the volume per specified resolution. It can be used for analysis only. Trading directly from this chart type is not supported.

Selecting Cumulative Delta Chart Option

- Open the Format Instrument window by one of the following methods:

- Select the Instrument tab.

- Select a data feed from the Data Source list.

- Select a symbol from the list of available symbols in All Instruments tab, or use the Category tabs to show only a particular category of symbols; the list can be sorted by any column, in ascending or descending order, by clicking on the column header. If you can’t find a symbol, see Adding Symbol(s) to Symbol List section.

- Select the Settings tab.

- Select the Resolution your chart will be based on. It allows you to choose which type of data (for more details see Tick, Minute and Daily Data) and what detailed resolution will be used for building the bars.

- Enable Show Delta section and choose Cumulative Delta from the Delta Type dropdown list.

- Select Breakdown by:

- Up Ticks vs Down Ticks method:

- If the current tick price is higher than the previous tick price, the volume of the current tick goes to BUY volume.

- If the current tick price is lower than the previous tick price, the volume of the current tick goes to SELL volume.

- If the current tick price is the same as the previous tick price, the volume is recorded either to BUY or to SELL volume depending on what was the last recorded volume.Example: If a new tick comes with higher than previous price and volume is recorded as BUY volume, and then another tick comes with the same as previous price, the volume is recorded also to BUY volume.

- If a tick is first one in the series, its volume goes to BUY volume.

- Ask Traded vs Bid Traded method:

- If the current tick price is higher or equals current ASK tick price, the volume of the current tick goes to BUY volume.

- If the current tick price is lower or equals current BID tick price, the volume of the current tick goes to SELL volume.

- If the current tick price is between ASK and BID prices, than the volume is recorded either to BUY or to SELL volume depending on what was the last recorded volume.Example: If a new tick comes with a price higher or equals current ASK tick price and its volume is recorded as BUY volume, and then another tick comes with a price that is between ASK and BID prices, the volume is recorded also to BUY volume.

- Up Ticks vs Down Ticks method:

- Select Build from to choose which type of data shall be utilized to build Cumulative Delta:

- If Ticks is selected:

- - In case Breakdown by = Ask Traded vs Bid Traded, MultiCharts will request historical tick ask and bid data from the data source for selected data range irrespective of the chart resolution to build Cumulative Delta chart.

- - In case Breakdown by = Up Ticks vs Down Ticks, MultiCharts will request historical tick trade data from the data source for selected data range irrespective of the chart resolution to build Cumulative Delta chart.

- Minutes option is available if the basic resolution in chart settings is bigger than one minute.

- - If Minutes is selected, MultiCharts will request historical minute trade data from the data source for selected data range irrespective of the chart resolution to build Cumulative Delta chart.

- Days option is available if the basic resolution in chart settings is bigger than one day. Note: Minutes and Days options are not available if Breakdown by = Ask Traded vs Bid Traded.

- If Ticks is selected:

- Click OK to create a chart.

Setting Cumulative Delta Chart Style (Open, High/Low, Close, Up, Wick, Down)

- Open the Format Instrument window by one of the following methods:

- Click the Format Instrument icon on the Chart Analysis toolbar; if the Format Objects window appears, select the symbol and click the Format button; or:

- Position the mouse pointer over the symbol's data series; double-click once the Pointer

changes into a Hand

changes into a Hand  ; or:

; or: - Position the mouse pointer over the symbol's data series; once the Pointer

changes into a Hand

changes into a Hand  , right-click and then click Format 'Symbol Name'; or:

, right-click and then click Format 'Symbol Name'; or: - Right-click on an empty area of the chart and then click Format Instrument; if the Format Objects window appears, select the symbol and click the Format button; or:

- Select Format in the main menu and click Instrument; if the Format Objects window appears, select the symbol and click the Format button.

- Select the Style tab.

- Select one of the 6 available chart types:

- OHLC Bar

- HL Bar

- Candlestick

- Line on close

- Histogram

- Invisible bars

- In the Chart Style section click on the component element to be changed.

- In the Color column select one of the standard 40 colors from the palette box, or click the Other button to create custom colors.

- From the Width list select a width of the component.

- To apply the most recently selected component's style to all components, click the Apply to All Components button.

- To display the Last Price Marker select the Last Price Marker check box, or clear the box to hide the marker; the color of the marker can be selected in the Chart Style section.

- Last Price Marker Line option is used to display a line showing the last price level along the length of the chart. The color of the line can be set in the Chart Style section.

- To show candlestick borders, select Show Candlestick Border check box; clear the box to hide the border. This option works for Candlestick chart style only. The style of the border is the same as of the Wick.

- To use these style settings for all new charts of this type, select Use as Default check box.

Auto Trading and Backtesting on Cumulative Delta Chart Style

Intra-Bar Order Generation is supported on Cumulative Delta chart type. Bar magnifier is not supported. To learn how Intra-Bar Order Generation on Cumulative Delta Chart Type, see this page

Backtesting

There is no difference in order generation between Regular and Cumulative Delta chart types with regards to backtesting. The basis of Cumulative Delta chart is volume, not price, so the orders are executed based on volume, not on price.

Order Generation in Data Playback

There is no difference between order generation on Regular and Cumulative Delta chart types with regards to data playback. Only As Is type of Data Playback is available for Cumulative delta chart type.

Real-Time Simulation

There is no difference between order generation on Regular and Cumulative Delta chart types with regards to real-time order simulation.

Auto Trading

Auto trading is not allowed for this chart type.