Kagi

Jump to navigation

Jump to search

Contents

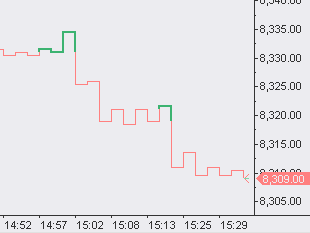

Understanding Kagi Chart Type

It uses a series of vertical lines to illustrate general levels of supply and demand for certain assets. Thick lines are drawn when the price of the underlying asset breaks above the previous high price and is interpreted as an increase in demand for the asset. Thin lines are used to represent increased supply when the price falls below the previous low.

Selecting Kagi Chart Type

To create a new chart:

- Open the Format Instrument window by one of the following methods:

- Select the Instrument tab.

- Select a data feed from the Data Source drop-down list box.

- Select a symbol from the list of available symbols in All Symbols tab, or use the category tabs to list only a particular category of symbols; the list can be sorted by any column, in ascending or descending order, by clicking on the column header. If you can’t find a symbol, see Adding Symbol(s) to Symbol List section.

- Select the Settings tab.

- Select Kagi from the Chart Type list.

- Enter the Reversal and Resolution in the corresponding boxes.

- Select Break on Session if you want to see the session breaks.

- Double-click the symbol, or click OK, to create a chart with the default settings.

Selecting Kagi Chart Style

Chart style can be selected from the Format Instrument window:

- Open the Format Instrument window by one of the following methods:

- Click the Format Instrument icon on the Chart Analysis toolbar; if the Format Objects window appears, select the symbol and click the Format button; or:

- Position the mouse pointer over the symbol's data series; double-click once the Pointer

changes into a Hand

changes into a Hand  ; or:

; or: - Position the mouse pointer over the symbol's data series; once the Pointer

changes into a Hand

changes into a Hand  , right-click and then click Format 'Symbol Name'; or:

, right-click and then click Format 'Symbol Name'; or: - Right-click on an empty area of the chart and then click Format Instrument; if the Format Objects window appears, select the symbol and click the Format button; or:

- Select Format in the main menu and click Instrument; if the Format Objects window appears, select the symbol and click the Format button.

- Select the Style tab.

- In the Chart Style section click on the component element to be changed.

- In the Color column select one of the standard 40 colors from the palette box, or click the Other button to create custom colors.

- From the Width list select a width of the body border and the wick.

- To apply the most recently selected component's style to all components, click the Apply to All Components button.

- To display the Last Price Marker select the Last Price Marker check box, or clear the box to hide the marker; the color of the marker is the same as the color of the Down component.

- To use these style settings for all new charts of this type, select Use as Default check box.

Auto trading orders on Kagi Chart Type

There are some differences between Regular and Kagi chart types with regards to order generation in real time and backtesting.

Backtesting and Data Playback

There is no difference between order generation on Regular and Kagi chart types with regards to Backtesting and Data Playback.

Real-Time simulation

| Type of the strategy | Regular Chart Type | Kagi Chart Type |

|---|---|---|

| Buy next bar at market | Order is placed on the first tick of the new bar, i.e. on the Open of next bar. | Order is placed on Open of next column, not on the first tick but only when column’s status turns from in-progress into fixed*. |

| Buy this bar at close | Order is placed on the last tick of the bar, i.e. on the Close of the current bar. | When a column’s status turns from in-progress into fixed*, the order is placed at the Close price of the previous column. |

| Price orders | Order is placed at the price of the first tick that satisfies Stop and Limit conditions. | Order is placed either on the last, closing tick of a column or on the Open of the bar after the column has been closed (if it is guaranteed to be filled) taking into account Stop or Limit conditions. |

* After the resolution time frame has passed.

Auto Trading

| Type of the strategy | Regular Chart Type | Kagi Chart Type |

|---|---|---|

| Buy next bar at market | When the first tick of a new bar comes, the market order is sent to the broker. | When the next column’s status turns from in-progress into fixed*, a market order is sent to the broker. |

| Buy this bar at close | When the last, closing tick comes, the market order is sent to the broker. | When the next column’s status turns from in-progress into fixed*, a market order is sent to the broker. |

| Price orders | When the auto trading is on, a price order is sent to the broker. | When the auto trading is on a price order is sent to the broker. |

* After the resolution time frame has passed.

To learn how Intra-Bar Order Generation and Bar Magnifier work on Point and Figure Chart Type, see this page