Level 1 vs Level 2 Market Data: Difference between revisions

No edit summary |

No edit summary |

(No difference)

| |

Latest revision as of 16:09, 17 May 2024

Level 1 and Level 2 data provide valuable information to traders in the financial markets. While Level 1 data is widely available and provides a basic view of the market, Level 2 data offers a more detailed view of the market depth and the identities of traders placing orders. It is important for traders to understand what Level 1 and Level 2 Market data is and how to use them appropriately in their trading strategies.

What is Level 1 Market Data?

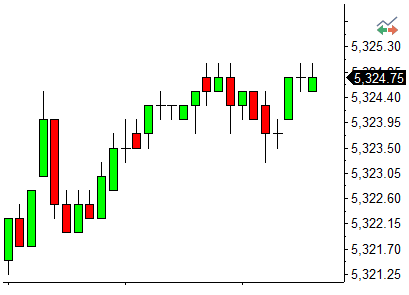

Level 1 trading data is a type of financial market data that includes real-time pricing and volume information for individual securities.

Level 1 data includes:

- Bid and Ask Prices - the highest price a buyer is willing to pay (bid) and the lowest price a seller is willing to accept (ask).

- Last Trade Price - the price at which the last trade for the security was executed.

- High and Low Prices - the highest and lowest prices at which the security has traded during the current trading session.

- Volume - the total number of shares of the security that have been traded during the current trading session. Here are some tools that MultiCharts offers for Volume Analysis.

Level 1 data can be accessed on the chart and Portfolio Trader and can be used for Standard Simulated Trading.

What is Level 2 Market Data?

Level 2 trading data provides more in-depth information compared to Level 1 data and gives additional data points beyond the bid, ask, last, volume, high, and low.

Level 2 data includes:

- Order Book that provides a detailed view of the outstanding orders for a security, including the size of each order, the price at which it is placed, and the identity of the trader or market maker who placed the order.

- Market Depth that refers to the number of orders at different price levels in the order book. You can access this data in our Depth-of-Market.

- Bid and Ask Sizes at each price level. You can check the volume at each price level if you enable the Volume Profile in the DOM window.

- Time and Sales that provides a chronological view of all the trades that have taken place for a security, including the size, price, and time of each trade. You can access this info in our Time and Sales.

How to use Level 2 Market data?

Level 2 data provides a more comprehensive view of the market, which can be particularly valuable for professional traders and institutions who require detailed information for making informed trading decisions.

Starting with MultiCharts 15 you can use Level 2 data in Advanced Simulated Trading to test your trading strategy even more comfortably and closer to reality.

Where to get Level 2 Market data?

Level 1 and 2 data for Simulated Trading can be downloaded or collected from any supported data provider or from our servers using the Market Data Sim feed that provides several months of minute and one week of tick Level 1 and Level 2 data for Futures, Crypto, Stock, Forex and Index instruments.