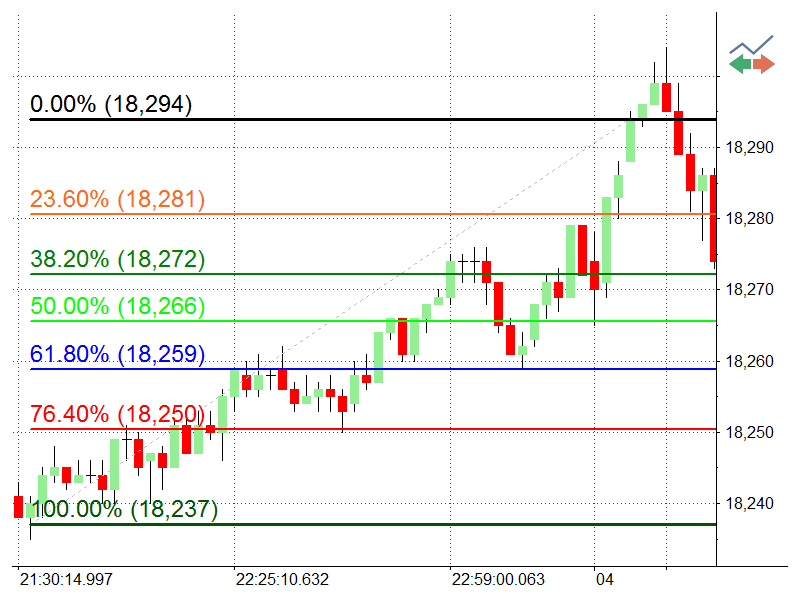

Andrews' Pitchfork

This drawing tool helps predict the support and resistance areas in a trending market. It consists of three parallel lines—usually drawn from three consecutive major peaks or troughs.

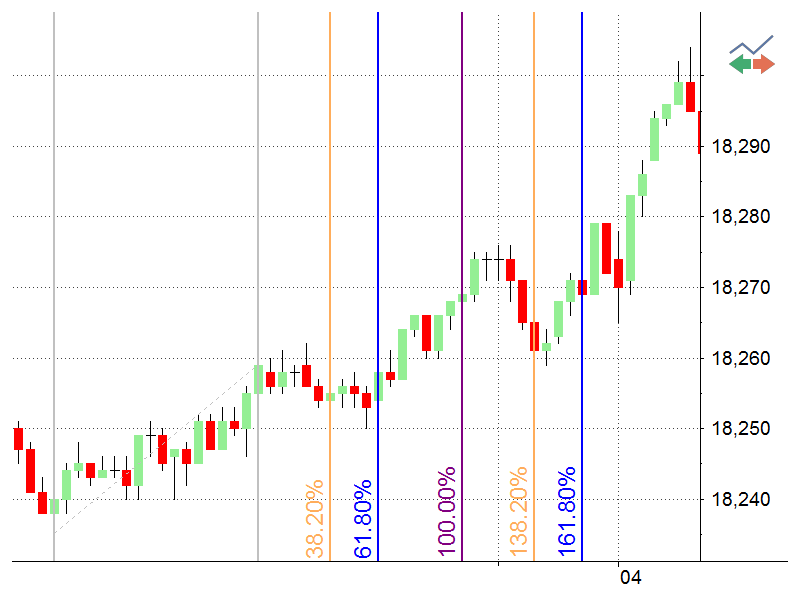

Fibonacci Speed/Resistance Fan

This analytical drawing tool indicates support and resistance levels of an existing trend and the price level at which possible changes in the trend may occur. You can draw up to 11 lines based on any selected distance percentages as well as Fibonacci percentages.

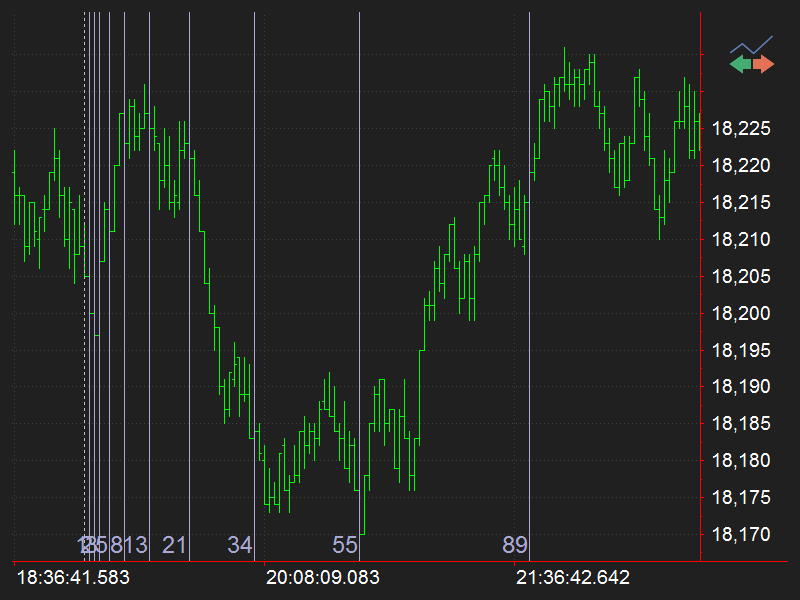

Fibonacci Trend-Based Time Lines

This analytical drawing tool predicts future price corrections and examines support and resistance levels, as well as price breakouts. It is represented by a series of vertical lines at date and time levels, which show probable price corrections in the existing trend.

Gann Fan

This analytical drawing indicates time and price movements from important highs and lows, and it identifies price breakouts. Angled lines fan out from the selected point. They indicate a time-to-price relationship that may be relatively fast or relatively slow, depending on the size of the Gann angle.

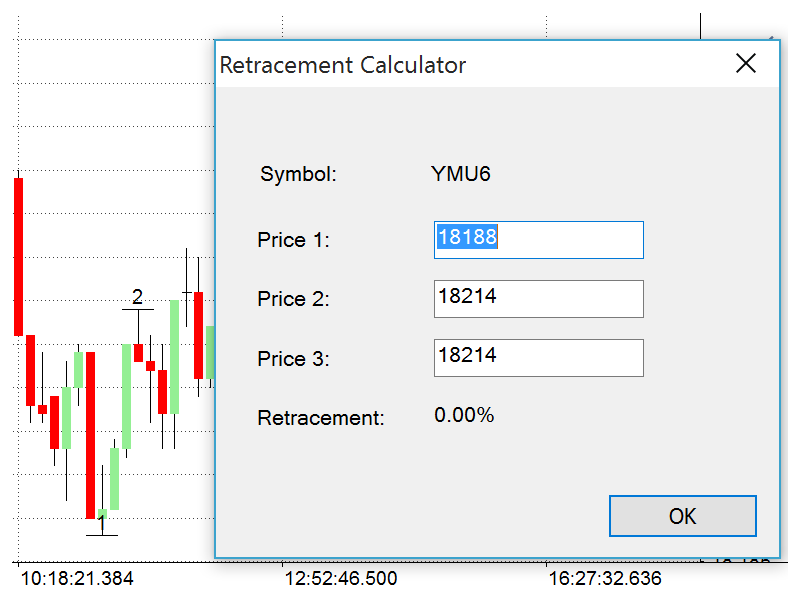

Retracement Calculator

This analytical drawing tool predicts future price corrections and examines support and resistance levels, as well as price breakouts. It is represented by a series of vertical lines at date and time levels, which show probable price corrections in the existing trend.

Extended Parallel Lines

This analytical drawing tool draws parallel trend lines that are extended to the left and right on the chart. They outline the equidistant channel in which the market trades. The upper horizontal line is the resistance line. The lower horizontal line is the support line. If either of these lines is penetrated, a price breakout may occur.

Regression Channel - Segment High-Low

This is a channel based on a regression line, which is calculated from open, high, low, and close values. The upper line is based on the highest value for the period and the lower line on the lowest value. The outer bounds outline the equidistant channel in which the market trades.

Regression Channel - Raff Regression

Gilbert Raff developed this analytical drawing tool, and it precisely defines a price trend and its support and resistance levels. It is represented by two parallel equidistant lines drawn above and below the linear regression line, and it is based on the maximum upward and downward oscillation.

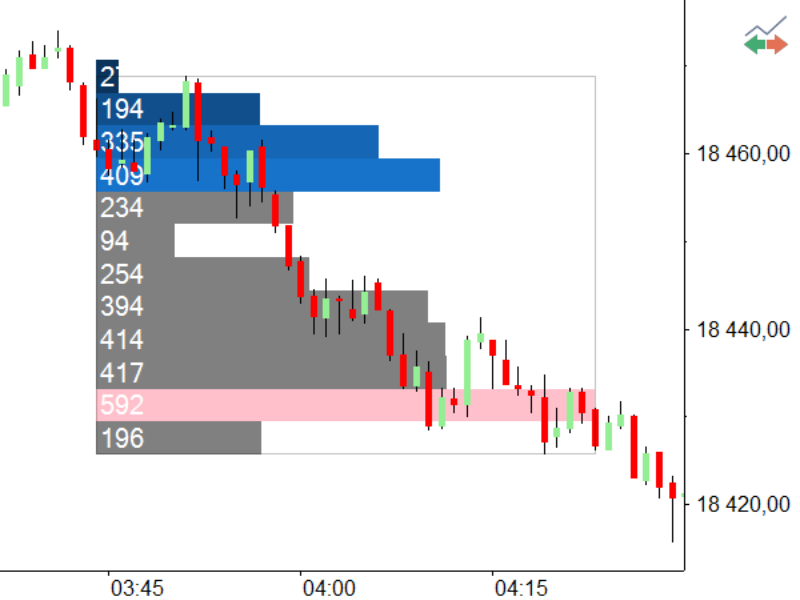

Volume Profile

This analytical drawing tool inserts Volume Profile as a drawing. It tracks trading activity volume across different price levels and varying time lengths.

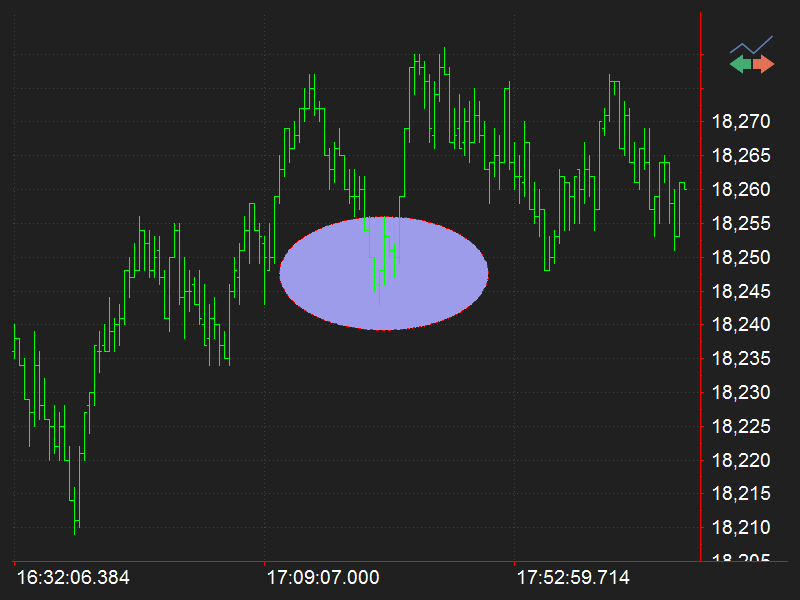

Arc

This is a non-analytical drawing tool that looks like an arched line, and it’s used for highlighting necessary chart segments. Arcs can be drawn at any angle.