MultiCharts is delighted to announce the release of MultiCharts Discretionary Trader – free version of our award-winning software.

This free trading platform includes most of the features of our flagship product, and is truly a groundbreaking step in evolution of free trading software. It was designed for traders that don’t need complex indicators and custom programming, and who want to trade without paying for software. It’s perfect for scanning the market, practicing using market data playback and placing simulated or live trades.

The best things in life are free – and MultiCharts DT is one of them. Get your free copy, use it for as long as you want, and you never have to pay.

MultiCharts DT takes free trading software to a whole new level – to our knowledge there is no comparable product available for free in the market – in terms of quality, stability and features. We think that the only way to truly learn to trade is to do it – now you can trade without having to pay for software beforehand. Practice your trading on a simulated account, and get the full version if you start needing custom indicators, programming and algorithmic trading.

The free MultiCharts DT project is also a pilot program to test all new features that will be added to the full MultiCharts program. MultiCharts DT users will always be the first ones to use newest additions and developments. You can compare versions here, and get the free trading platform here.

We would like to thank our pre-alpha testers for invaluable input – thanks to their feedback we have been able to make major improvements to the program. We won’t name all of the contributors here, but we thank you all for your help. Special thanks to Tresor, geizer, SP, sptrader, and TIKITRADER.

KEY FEATURES

Manual Trading

Extensive and feature-rich manual trading includes the following major components:

- Visual Chart Trading

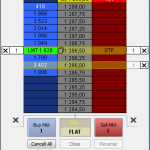

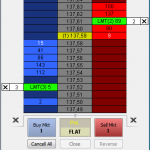

- Depth of Market window (DOM)

- Trade Bar toolbar

- Entry Automation

- Exit Automation

You can find more details in the sections below.

Visual Chart Trading

A major improvement, one of the most useful ones, is trading directly from a chart. It’s perfect for traders that need to react instantly to market changes and always see the big picture. It’s intuitive, easy to use, and provides the necessary tools to stay on top.

We offer our users chart trading that is very rich visually and in functionality. You can create orders either from a convenient panel on the right-hand side, or by right-clicking on the chart. The chart trading panel allows you to specify all necessary details for your order, including the number of contracts, type of order, order duration and so on. The chart is cursor-sensitive, so right-clicking the chart will create an order at the price level you clicked on. You may also drag-and-drop orders directly to specific prices on the chart, and the orders will appear at those prices.

You can apply single orders and entire strategies using the methods described above. MultiCharts supports simple single orders, One-Cancels-Other order groups (OCO), as well as automated entry and exit strategies. The Entry Automation and Exit Automation strategies can be applied by drag-and-drop or by right-clicking to individual orders, and entire positions. More on automation of entries and exits can be found in dedicated sections below.

After you have placed the order, it’s easy to add to it, change it, or cancel it. You can use double-click, right-click, or the panel on the right-hand side. Strategy levels (such as profit target and stop loss) can also be easily changed and moved around. Strategy names are shown on the appropriate levels, so you always know where the orders came from.

Active orders are shown in a bright color, while dependent pending orders (which wait for the active order to occur before becoming active) are shown in transparent colors. Changing the size, or the price, of the parent order will automatically recalculate and update the dependent orders.

Entry Automation

This feature allows you to automate certain methods of entering positions. It’s perfect for avoiding repetitive tasks, increasing your productivity and focusing on trading. Automation is especially useful when you need to apply an order pair quickly. Entry Automation strategies can be applied to an existing order via drag-and-drop, or right-clicking.

There are currently four entry strategies – Breakout, Fade, Breakout Up/Fade, and Breakout Down/Fade.

Each strategy is an OCO group – if one order is filled, the other is canceled. You can visually change the order levels, which saves a lot of time when managing your orders. You can also change the parameters through detailed dialog windows. You can specify absolute values for price levels, or define the distance of your brackets in percent values or points (pips).

Each strategy can be saved as a template to be used later, and you can create up to 4 templates per strategy. These strategies can also be applied in the DOM window; you can find more information in the DOM section.

Exit Automation

Some traders maintain that exiting a position properly is more important than entering. Exit automation is a sophisticated feature that allows you to automate certain methods of exiting positions. It essential for times when the market is moving too quickly to place exit orders manually and you need to react instantly to protect your investments.

There are currently five exit strategies– Bracket Orders, Breakeven, Trailing Stop, Stop Loss, and Profit Target.

Exit automation allows you to set targets and trigger levels in seconds, when you need them most. You can carefully structure conditions that you want, and mix several strategies together to work in tandem. To apply a strategy to an existing order you can drag-and-drop it from the menu, or right-click on the order. What’s more, you can apply exit strategies to entire positions, not only individual orders. You can drag-and-drop the strategies to the small white box that indicates the position.

Contrary to competing products, exit strategies in MultiCharts DT are treated individually. For example, you can apply Breakeven and Profit Target strategies without having to configure the Stop Loss strategy. You can mix-and-match the strategies, and apply only what you need – all for unparalleled flexibility. At the same time, we recognize that there are instances where all parts of the strategy need to work as one whole – a multi-level strategy where all components interact closely with one another. This functionality will be released in the next (beta) version of MultiCharts and MultiCharts DT, approximately at the end of February 2011.

In addition to active and pending orders, you will see Trigger levels on the chart; the price must cross these levels in order for pending orders to activate. You can easily change the trigger levels and the pending exit orders by dragging them with your mouse. If you don’t like the new level, press Escape on your keyboard while dragging.

Just like in entry automation, each strategy is an OCO group – if one order is filled, the other is canceled. You can visually change the order levels, which is a must-have feature in fast markets. You can also change the parameters through detailed dialog windows when you have more time. You can specify absolute values for price levels, or define the distance of your brackets in percent values or points (pips).

Each strategy can be saved as a template to be used later, and you can create up to 4 templates per strategy. These strategies can also be applied in the DOM window; you can find more information in the DOM section.

Auto-Apply Exit Automation

One of the key features in exit automation is the ability to auto-apply strategies to every new order you create – for the times you need to react instantly. If the market is fast, by the time you place your exits manually, it could reverse – and you need to start all over again. Auto-application is an essential tool to stay current.

If you double-click on an exit strategy, or a template you made, it will get a green check mark symbol on top of it. Every new order will have the appropriate strategy automatically placed. You can auto-apply several strategies at the same time.

However, sometimes you may wish to place an order without the exit strategies, but don’t want to re-do your entire setup. For that we have a convenient Pause button, which saves your settings, but will pause auto-applying until you re-enable it. This button will also show you how many strategies you are auto-applying at any given time. The convenience and the flexibility allow you to focus on what matters most – trading when you want.

Depth of Market (DOM) Window

This feature has been on the wish-list of MultiCharts users for a long time. This specialized window allows you to see the amount of supply and demand (ask and bid) for a particular financial instruments at different prices.

The following brokers are currently supported through the DOM:

- Interactive Brokers

- MB Trading

- Open E Cry

- PFGBEST

- Patsystems

- Rithmic

- Trading Technologies

- Zen-Fire

*Dukascopy and FXCM are not currently supported in the DOM, but are available for chart trading.

The DOM in MultiCharts has two modes of operation – dynamic and static. You can choose the type you need through a right-click.

Static DOM mode means the DOM window will re-center once the price hits the upper or lower boundary of the window. You will receive a 5 second countdown, and it will re-center. Technically, our DOM is semi-static because it moves, but we call it ‘static’ for simplicity.

Dynamic DOM mode means the DOM window will automatically re-center after each new tick (price update) received. This mode is useful for scalping strategies. You can choose the mode that you prefer.

You can drag-and-drop orders and entire strategies, or apply them with a right-click. We have added advanced coloring visualization that is the same as in chart trading – active orders are in solid colors, and pending orders are transparent.

Trade Bar

Trade Bar looks like a standard toolbar in most modern browsers. It contains a series of tabs, and you can trade through different brokers by switching tabs. The Trade Bar allows you to trade from any place in the application, no matter if you are viewing charts, performance reports, or scanning the market.

The main advantage is that you can see all of the currently connected brokers, and place orders through several brokers at the same time. For example, you may have one broker for Forex and another one for futures, and place orders on both without logging in or out.

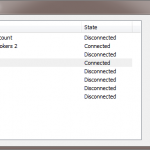

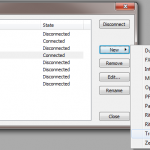

Broker Profiles

We have introduced a different way of managing brokers you trade through, to save time and effort on your part. All information about the broker plug-in configuration is now stored in a corresponding profile, and you can make several profiles for the same broker. This is very useful if you want to trade through two or more brokers at the same time, switch between them quickly and effortlessly.

The biggest advantage is the ability to trade several brokers at the same time from one trading platform. There is no need to purchase two software licenses, have multiple programs or multiple computers to trade from. You can simply connect two, three, or more broker profiles, and place trades through each one.

Profiles can be accessed and managed through File > Broker Profiles.

Interactive Order and Position Tracker

You can see all of your orders from different brokers in one consolidated report. You can filter the reports by broker, which is very convenient for reviewing your performance, and keeping track of your activity. You can also place addition orders, cancel existing orders, or flatten your position directly from the tracker window.

Miscellaneous

- MultiCharts and MultiCharts Discretionary Trader can be installed and used at the same time on one computer. There is no conflict between the two programs.

- New toolbar icons in all applications

- New order status: Partially Filled

- There is a dedicated forum for MultiCharts DT – http://www.multicharts.com/discussion/

MultiCharts Team wishes you all success and happy trading.

looks like DT has many new 7.x features added already, when are we supposed to see the 7.x version for Multicharts non-free edition?

The beta version of the full MultiCharts version is expected to be released at the end of February 2010. The full version will get all of the features you currently see in MCDT, plus more.

Pingback: MultiCharts Discretionary Trader alpha | YKARIUS, journal d'un spéculateur

Pingback: Market Entry Strategy | Zillion Bits

Pingback: FREE MULTICHARTS !!!

What about executing a trade on different brokers with one click?

I don’t want to click N times for N broker, all trading the same signals. Can I put different accounts together into a block account with a predefined ratio between the accounts and trade this block account instead of each one?

You can do that with a Financial Advisor account at Interactive Brokers, and using a PAMM account at FXCM – along with specifying the correct allocation pattern among the accounts. However, doing that across multiple brokers is not currently within the scope of MultiCharts.

If you want to see this feature implemented in the future, I suggest you add it to our Project Management system. Other users can vote on the issue, and you can track the status of your feature request. You can do that here – http://www.multicharts.com/pm/

i want to trade nse which stock broker should i choose?

You can pick any supported broker that supports NSE (NYSE). I suggest Interactive Brokers, although you can use any other broker that supports Equities. OpenECry supports them, MB Trading, Rithmic, TT and Pats all support equities. Keep in mind, Rithmic, TT and Pats are frameworks, upon which many brokers are based. You should look around and pick one that suits your needs.

Pingback: chatt

Pingback: chatting room

Is the software Real-time quotes?

Hello, but where you can download the free version of this software?

Regards.

Hi,

You can get it through AMP Clearing – http://www.ampclearing.com

Amp MCDT ist just a 30 day demo. No ? I’m new in this theme, can somebody tell me, The original MCDT is a completly lifetime free software, what i can on live account at many brokers ?Or just trial with limits ?Thanks for help.

MCDT is free for use for as long as you want. There’s no trial for MCDT from AMP, it’s free forever.

Does it support real time stock data playback feature?

Real-time playback? Yes, you can do tick-by-tick replay on a single instrument.

Does MCDT have ATM option (stop loss and take profit) and does it have charting and chart trading?

Yes, it has all of those features.

It is still available the free version for LMAX? if yes, where can I find more details?

Thank You!